Trustcom Financial UAB is the Lithuanian electronic money institution founded in 2017. It holds the Electronic Money License with the Bank of Lithuania.

Main Features

– Personal and business accounts

– Virtual personal and business IBAN

– SEPA and SWIFT payments

– MasterCard Prepaid Cards

– Online account opening

– Expense planning and controlling tools in the internet banking

Cons

– Cryptocurrencies are not accepted

– Chat support from 9.00 to 18.00 CET on working days

– No deposit guarantee

Personal Accounts

Personal Accounts can be opened by residents and non-residents of Lithuania. It can be used for online purchases and international transfers. Customers can access their accounts through Trustcom Financial app, tablet or computer.

Business Accounts

Business Account is aimed at companies and freelancers who trade inside and outside Lithuania. It offers reliable and functional online banking tools.

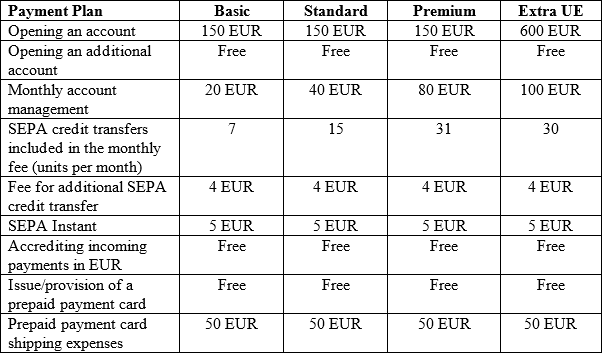

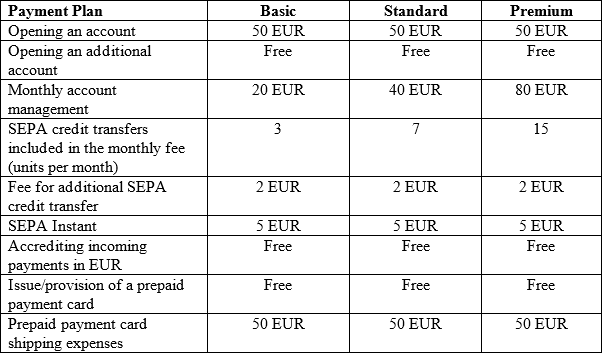

Trustcom offers a selection of several payment plans for non-residents, including Basic, Standard, Premium and Estra UE. Clients have a wide choice to opt from when they are looking for payment plans needed for their businesses.

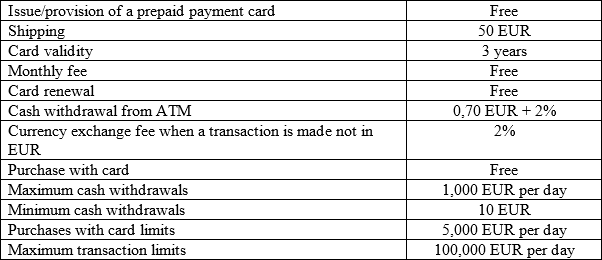

MasterCard Prepaid Cards

With Trustcom Financial, customers keep track of expenses when accessing their Internet banking or application. Within it, they can check their balance and get a detailed account information in PDF.

Trustcom Financial card allows to carry out numerous day-to-day operations, such as paying utility bills, renting a car, recharging a mobile phone balance, booking a hotel, etc. Trustcom cards have contactless technology for quick in-store purchases.

Trustcom Financial prepaid card has a maximum withdrawal limit of €1,000 per day, for both Personal and Business accounts. Cash can be withdrawn at any ATM, anywhere in the world. POS payments are commission-free and balance requests are free as well.

Trustcom Financial Sandbox

One of the most important advantage is that Trustcom Financial has launched its PSD2 sandbox for integration and testing. Third party vendors are able to integrate and test Trustcom’s PSD2 API sandbox. The purpose of the API is to allow TPPs to start payments and retrieve financial information from a Trustcom customer’s account, based on the explicit consent of the account holder. So, the customers are able to use the sandbox to test new features within staging environment, so that it would be converted to a final product.

Security Issues

Trustcom Financial ensures the safety of customers’ accounts. It uses the method of segregation of customers’ funds from Trustcom Financial’s own funds. Customers’ funds are held in a separate bank account opened for the clients of Trustcom.

Trustcom uses a three-level security architecture, including:

– Secure login: mobile app and internet banking login details consist of username and password or fingerprint / facial recognition (depending on the smartphone);

– Confirm PIN: 6-digit code is required every time to make a transfer or connect/disconnect a phone;

– Instant push notifications: for each incoming and outgoing payment, a push message will be sent to the connected smartphone. It is also used to confirm the finalization of transactions. Trustcom has also implemented 3D Secure to protect customers from online card fraud.

Pricing

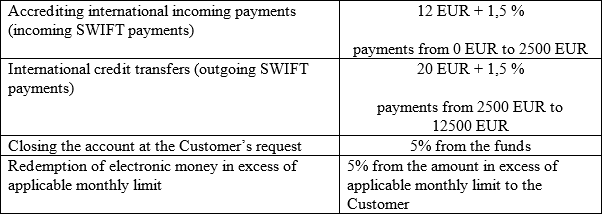

Business Accounts for non-residents of Lithuania

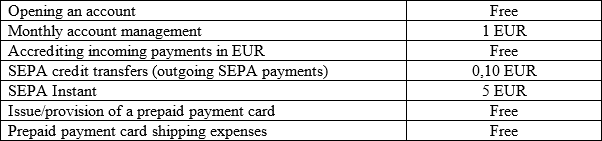

Business Accounts for residents of Lithuania

Business Account Fee for both residents and non-residents

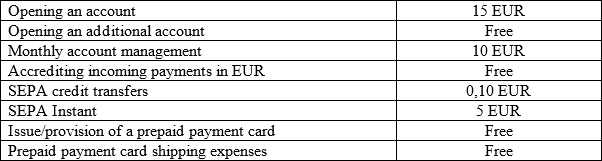

Personal Accounts

Non-Residents of Lithuania

Residents of Lithuania

MasterCard Prepaid Payment Card

Insert our promo code to get this benefits: AB1009SL

Open your Trustcom Financial account online