DynaPay business and merchant accounts for international business

Overview of DynaPay

DynaPay Limited is the payment provider regulated by the Financial Conduct Authority in the UK. It offers flexible financial services, among which are acquiring, online payment, payment card processing, issuing electronic money and much more.

With DynaPay customers can open payment accounts for small and medium-sized businesses operating globally and locally. DynaPay does not have personal accounts.

Founded in 2004 in London, it has offices in Canada, Colombia, Cyprus, Egypt, India, Latvia, Malta, Moldova, the Philippines, Romania, Russia and USA with its headquarter in London, UK. Its business plans start at 0$ which is a good option for a free trial of the platform.

DynaPay is a part of Dyninno Group totaling more than 2,000 employees worldwide.

Recently, it announced that it partners with Banking Circle for delivering secure payment solutions for SMEs transacting globally and in multiple currencies. Banking Circle’s financial infrastructure is created to payments businesses and banks. It facilitates quick, low cost, compliant and secure payments.

Main Features

Website: https://dynapay.co.uk

DynaPay offers:

– Business Account

– Merchant Account

– No minimum deposit

– Quick account opening within 24 hours

– GBP, USD, EUR IBANs

– Currency exchange in 38 currencies

– Supported payment methods are SEPA, SWIFT, Target2, Faster Payments, CHAPS, ACH and FedWire

– 24/7 customer support

– Tokenised card details for scheduled payments with merchant account

– High security standards

– Customizable and white-label solutions

Cons:

– No personal accounts

– Cryptocurrencies are not supported

– No payment cards (but this option will be available in the future)

Business Accounts

DynaPay conducts AML check within 24 hours to ensure fast onboarding. DynaPay has restrictions on the jurisdictions accepted for account opening. Currently, DynaPay accepts EU, EEA, Hong Kong and Canadian companies.

DynaPay onboards any type of low-risk business, including tourism, ticket sale, retail goods, hosting, retail services, direct marketing, professional services, forex, gaming. It is important to note that risk businesses are accepted, provided these are EU licensed gambling or other regulated/licensed businesses.

For account opening, it is required to provide with the following documents:

– Proof of incorporation details (e.g. certificate of incorporation, articles of association, full extract from the company register);

– Proof of all Directors authority and Shareholders/UBOs (e.g. certificate of incorporation, articles of association, full extract from the company register, certificate of directors);

– Shareholders/UBOs structure (if a company has more than 1 shareholder).

Additional documents are necessary if a company’s business address is different from registered. In this case, DynaPay requires:

– Proof of a company’s business address (e.g. Utility bill dated within the last 3 months, office lease agreement or similar).

Customers expecting to make or receive payments in the amount of more than 5,000 EUR will be requested to provide proof of source funds. For this purpose, customers can submit latest audited/unaudited annual financial statements, transaction agreement between the parties, company bank statements).

All documents can be uploaded as scanned versions.

Once a company’s account is opened, the customer gets IBAN in the customer’s name.

Merchant Accounts

DynaPay merchant account enables its customers to process secure Visa and MasterCard payments. This payment gateway provider implements security, cyber-crime and fraud prevention features to protect companies’ payments.

With DynaPay merchant account customers get access to integration via payment link or host-to-host integration through open API with merchants’ website or app.

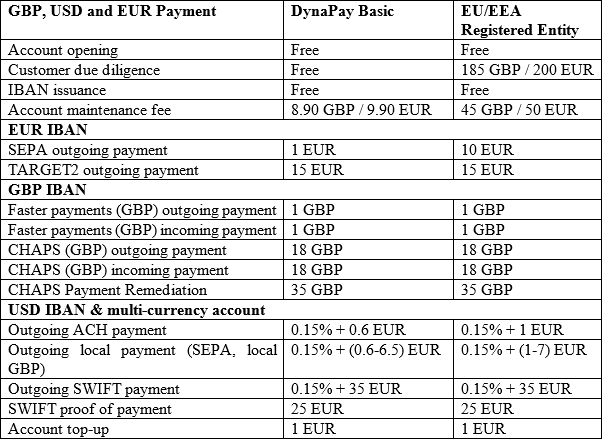

Tariffs