Melio Payments for US businesses and freelancers

Overview of Melio

Melio onboards United States domiciled business entities and freelancers. This payment provider offers free, simple and secure digital accounts payable and receivable solution for small businesses. With Melio, small businesses can easily operate finances and improve cash-flow.

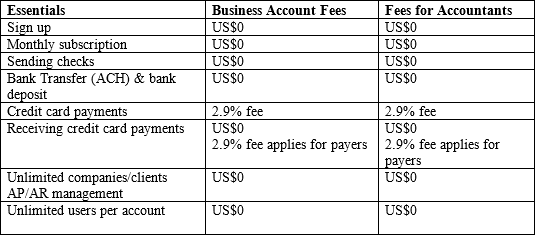

Through Melio account, customers can pay bills for free using ACH bank transfers, or use a credit card. Melio deducts a minimum of 2.9% fee which is a very attractive solution if compared to fees offered by similar institutions. Melio processes payments for vendors, suppliers, and other business payment recipients.

Melio’s customers enjoy the simple-to-use online dashboard that takes just minutes to set up. It allows small businesses to transfer and receive payments in a faster, easier, and more cash-flow savvy way.

Melio’s headquarters are at 205 Hudson st, 7th floor, New York City, New York, 10013.

Main Features

– Website:#nbsp;meliopayments.com

– Business Account for B2B payments

– Payment solutions for accountants

– Payments with a credit card, bank transfer, paper check

– Acceptance of digital payments

Cons:

– No personal accounts

– Cryptocurrencies are not supported

– US resident businesses only

Requesting payments

Melio is a free customized pay-page for receiving business payments digitally. It is a perfect tool for vendors that can request payment from their customers through Melio.

It is important to enable any payers to have convenient payment methods to complete transfers. And Melio perfectly understands that. As such, customers can easily respond to payment requests and transfer funds using credit credits or bank transfers. For example, with Melio it is possible to create and send trackable payment requests relating to specific invoices and monitor if they have been opened, scheduled, or paid. No need to sign up to complete the payment transfer.

Melio tools for accountants

Melio offers professional tools for accountants:

– Managing clients’ payments;

– Making bank transfers

– Sending checks

– Synchronization with QuickBooks that helps to integrate with bill payments

Safety Features

Melio uses state-of-the-art cryptographic algorithms during data transmission (HTTPS with RSA 2048 bit key and SHA 256 certificate) and in its databases (AES 256 encryption keys). Its servers are kept in PCI and SOC 1, 2, and 3 certified data centers with 24×7 monitoring.

The PCI DSS certification process is designed to protect customer sensitive data. Melio does not store any sensitive information on its servers (credit cards numbers and personal information such as SSN and DOB) but uses a card processor (TabaPay) which is a certified Level 1 PCI Compliant Service Provider (the highest level), which requires an annual independent security audit of its processes and systems.

Melio stores customers’ funds in its partner banks Evolve Bank & Trust and Silicon Valley Bank.

All Melio employees undergo background checks and security training. The development team follows a strict SDLC process which includes security validations and automatic penetration tests.

Tariffs