TransferWise and TransferGo are payment institutions and offer international money transfers with a focus on quick payments. These two payment institutions are among the most popular global transfer payment providers. Among the benefits of TransferWise and TransferGo are the following features:

- Mid-market conversion rates

- Multiple currencies

- Quick transfers

- Low fees

There are a few important differences between these two financial institutions that we would discuss in this article.

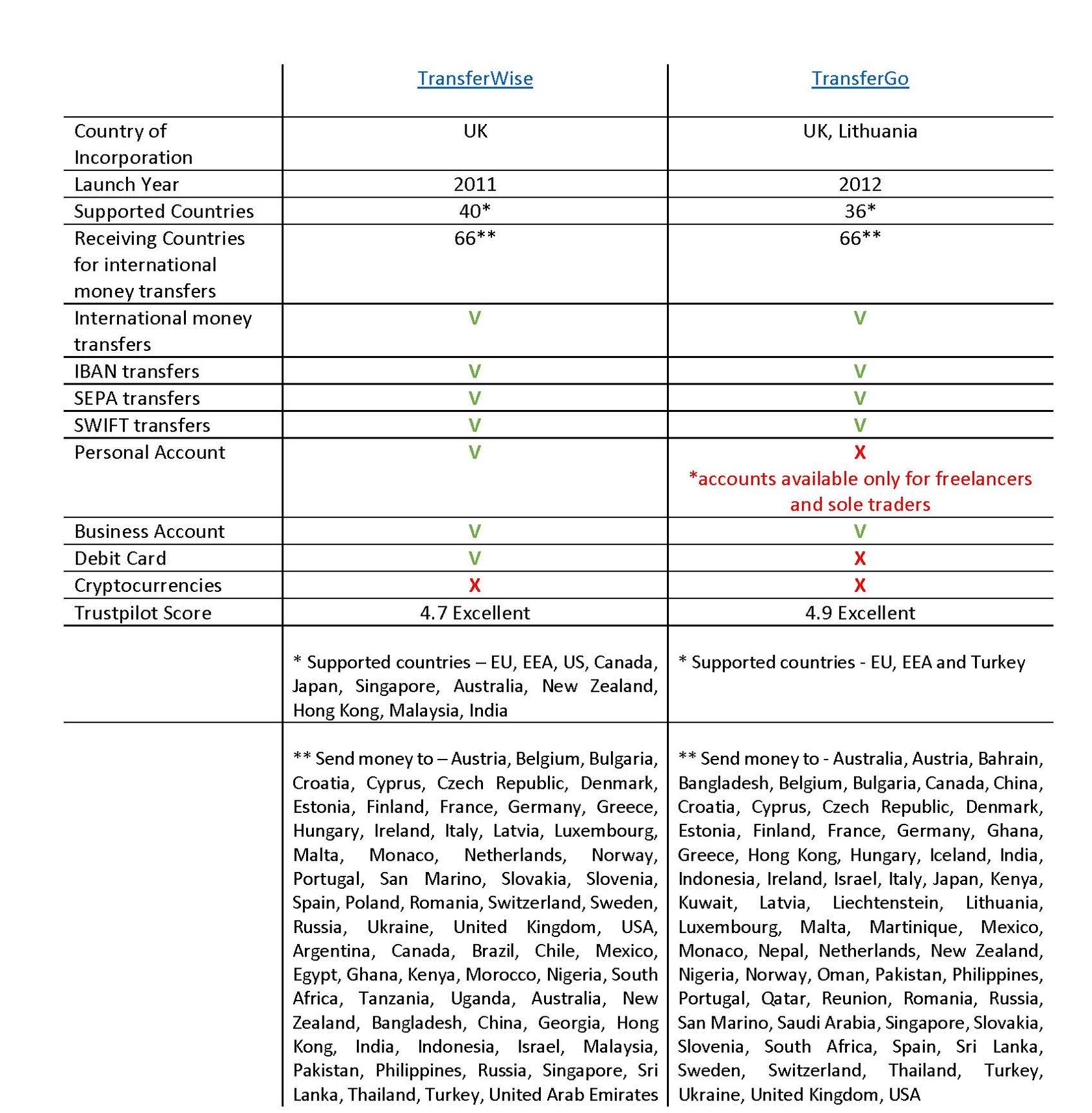

General Overview of TransferWise and TransferGo features:

TransferWise was launched in 2011 by two founders from Estonia. The payment institution primarily focuses on international money transfers with much lower fees compared to banking fees. As part of its business growth, TransferWise now allows to open online accounts and issue payment cards. These cards can be used internationally to purchase goods and withdraw cash from ATMs globally.

TransferGo was founded in 2012 by a few team members from Lithuania. Currently, it only supports international money transfers without the possibility to get cards or open personal/business accounts.

Thus, from the general overview of these two systems, it seems like TransferWiseprovides more options for its customers. It is possible to issue payment cards and open a Borderless Account which is specifically made for corporate clients that make a lot of international payments.

TransferWise supports more countries to which you can send money in comparison to TransferGo. Further, according to an online calculator, TransferWise provides lower commission on money exchange and transfer. In some cases, the difference can be 2-3% which is a significant amount for large transfers.

However, it does not mean that TransferGo is not worth trying. Currently, it provides different promotions for new customers. It has an excellent customers’ rate.

The great thing is that opening an account with TransferWise and TransferGo is free of charge, so you can try these two payment institutions to understand which one is better for your personal and business needs.