Paysera is a payment system that is registered in Lithuania and is the licensed electronic money institution to provide payment services in the European Union. Paysera serves individuals and businesses.

The payment system offers such products as payment solutions for e-stores, gaming or entertainment portals, restaurants and cafes; Paysera Checkout; mobile application; currency exchange at favorable rates; contactless debit Visa card; international transfers and ticket distribution system Paysera Tickets.

Recently, Paysera announced a new opportunity to purchase or sell gold online with the ability to obtain coins and ingots. More details about the new feature will be discussed below.

What are the advantages of Paysera?

Paysera is a Lithuanian payment institution with a set of standard payment instruments as well as non-standard products, which are rarely seen in other payment systems. Paysera provides access to many useful instruments in one place, from the possibility to accept payments to the possibility to purchase protective financial instruments.

Advantages:

- Online account opening

- Local support in English, Russian, Lithuanian, Latvian and other languages

- International payments to more than 180 countries in 30 currencies

- Ticket sales system for event organizers

- Software exchange and customer data management

- POS-system for processing mobile payments of individuals

- Ability to buy and sell cryptocurrency

- SEPA, SWIFT and IBAN payments

What types of accounts is it possible to open in Paysera?

Paysera provides personal and business accounts. You can open an account after successful verification. Potential corporate clients upload personal or corporate documents that are required for verification of an individual or a company. Due to recent audit of Paysera the verification process has become more complicated and the term has been extended to several days.

As part of a personal account, customers can have an IBAN account, instant transfers in Euro (SEPA), currency exchange with 30 currencies and contactless payment card. Customers can use the payment card to pay for services and goods in online and offline stores, as well as withdraw money from any ATM servicing Visa.

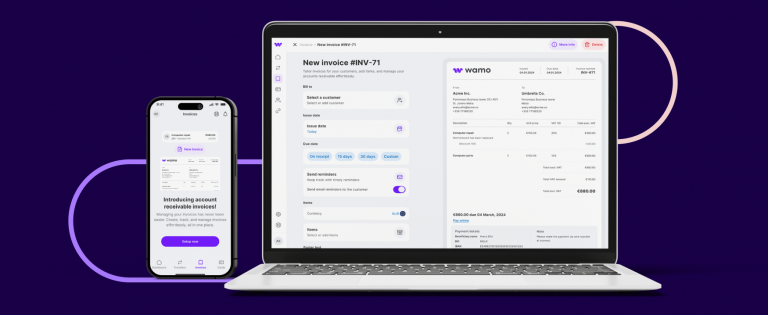

Paysera provides flexible solutions for business, including Paysera Checkout to collect payments, payments by SMS and QR codes. With Paysera it is possible to conduct escrow transactions in order to secure a transaction between a buyer and seller.

How to buy gold on Paysera?

Recently, Paysera announced a new financial product — trading gold online through Paysera. The clients of the payment institution have an opportunity to buy gold, as well as physical gold in the form of coins and ingots. Customers can use the depository of the payment institution.

This product is especially popular during the economic crisis and financial instability as gold is a protective tool against financial losses.

You can buy gold in part, in grams, in coins or ingots. With Paysera’s online platform, customers can sell precious metal at any time and send gold to other Paysera users. In the latter case, the gold value will be converted into the required currency.

Customers can store precious metals in Paysera or get physical gold or ingots. To collect physical gold or ingots, you need to visit the company’s customer service center in Vilnius.

To ensure compliance with the law and security, precious metals trading at Paysera is carried out in accordance with the Law on State Supervision of Precious Metals and Stones of Lithuania. In addition, Paysera is included by the Lithuanian Piercing Palace in the list of companies trading in precious metal bars, which also imposes an obligation on Paysera to ensure transparent and flawless activities.

Thanks to the above measures, buying gold online through Paysera is comparable to buying precious metals in the bank. And even easier and faster, as you can buy gold in Paysera application or online banking.

What are the consequences for Paysera due to the recent audit and penalty?

Recently it became known that the Central Bank of Lithuania conducted an audit of Paysera. According to its results, the company was fined on €370,000. However, as Paysera comments, this fine is significant and is equal to net profit for the three months of 2020. It intends to appeal the fine in court.

As a result of the audit, the Central Bank of Lithuania revealed significant violations of anti-money laundering legislation by the payment institution. In particular, Paysera did not meet the strict requirements of money laundering and terrorist financing risk assessment, when verifying the identity of customers by remote means. The payment institution did not apply enhanced measures to verify the identity of high-risk customers. At present, in Lithuania and on the territory of the European Union there are strict rules on enhanced verification of documents and information of persons who are in the high-risk group.

At the moment Paysera is improving the process of verification of clients identities, so the audit results affect the time of verification of documents that are downloaded by potential customers when opening an account. In addition, current customers are notified of the need to resubmit or submit additional documents for verification within Paysera.

This means that new and current clients are required to prepare proper copies of personal and corporate documents to undergo a new or repeated customer verification procedure. In some cases, the documents must be certified by a notary with an apostille.

Please contact our company if you have any questions about opening an account with Paysera or going through the verification process. We provide consulting services as well as online verification platform on which you can obtain personal and corporate documents duly certified for account opening purposes.